Page 38 - Policy Economic Report_Mar'25

P. 38

POLICY AND ECONOMIC REPORT

OIL & GAS MARKET

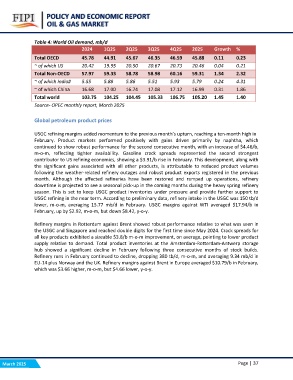

Table 4: World Oil demand, mb/d 2Q25 3Q25 4Q25 2025 Growth %

2024 1Q25

46.35 46.59 45.88 0.11 0.23

Total OECD 45.78 44.91 45.67 20.67 20.73 20.46 0.04 0.21

58.98 60.16 59.31 1.34 2.32

~ of which US 20.42 19.95 20.50 5.51 5.93 5.79 0.24 4.31

17.08 17.12 16.99 0.31 1.86

Total Non-OECD 57.97 59.33 58.78 105.33 106.75 105.20 1.45 1.40

~ of which India# 5.55 5.88 5.86

~ of which China 16.68 17.00 16.74

Total world 103.75 104.25 104.45

Source- OPEC monthly report, March 2025

Global petroleum product prices

USGC refining margins added momentum to the previous month’s upturn, reaching a ten-month high in

February. Product markets performed positively with gains driven primarily by naphtha, which

continued to show robust performance for the second consecutive month, with an increase of $4.46/b,

m-o-m, reflecting tighter availability. Gasoline crack spreads represented the second strongest

contributor to US refining economics, showing a $3.91/b rise in February. This development, along with

the significant gains associated with all other products, is attributable to reduced product volumes

following the weather-related refinery outages and robust product exports registered in the previous

month. Although the affected refineries have been restored and ramped up operations, refinery

downtime is projected to see a seasonal pick-up in the coming months during the heavy spring refinery

season. This is set to keep USGC product inventories under pressure and provide further support to

USGC refining in the near term. According to preliminary data, refinery intake in the USGC was 150 tb/d

lower, m-o-m, averaging 15.77 mb/d in February. USGC margins against WTI averaged $17.94/b in

February, up by $2.92, m-o-m, but down $8.42, y-o-y.

Refinery margins in Rotterdam against Brent showed robust performance relative to what was seen in

the USGC and Singapore and reached double digits for the first time since May 2024. Crack spreads for

all key products exhibited a sizeable $3.8/b m-o-m improvement, on average, pointing to lower product

supply relative to demand. Total product inventories at the Amsterdam-Rotterdam-Antwerp storage

hub showed a significant decline in February following three consecutive months of stock builds.

Refinery runs in February continued to decline, dropping 380 tb/d, m-o-m, and averaging 9.34 mb/d in

EU-14 plus Norway and the UK. Refinery margins against Brent in Europe averaged $10.79/b in February,

which was $3.66 higher, m-o-m, but $4.66 lower, y-o-y.

March 2025 Page | 37