Page 28 - Policy Economic Report - December 2025

P. 28

POLICY AND ECONOMIC REPORT

OIL & GAS MARKET

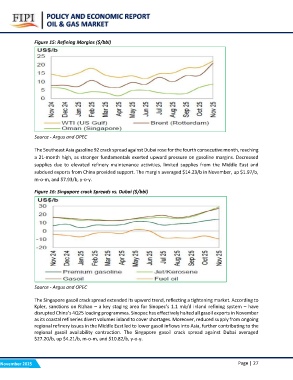

Figure 15: Refining Margins ($/bbl)

Source - Argus and OPEC

The Southeast Asia gasoline 92 crack spread against Dubai rose for the fourth consecutive month, reaching

a 21-month high, as stronger fundamentals exerted upward pressure on gasoline margins. Decreased

supplies due to elevated refinery maintenance activities, limited supplies from the Middle East and

subdued exports from China provided support. The margin averaged $14.23/b in November, up $1.97/b,

m-o-m, and $7.93/b, y-o-y.

Figure 16: Singapore crack Spreads vs. Dubai ($/bbl)

Source - Argus and OPEC

The Singapore gasoil crack spread extended its upward trend, reflecting a tightening market. According to

Kpler, sanctions on Rizhao – a key staging area for Sinopec’s 1.1 mb/d inland refining system – have

disrupted China’s 4Q25 loading programmes. Sinopec has effectively halted all gasoil exports in November

as its coastal refineries divert volumes inland to cover shortages. Moreover, reduced supply from ongoing

regional refinery issues in the Middle East led to lower gasoil inflows into Asia, further contributing to the

regional gasoil availability contraction. The Singapore gasoil crack spread against Dubai averaged

$27.20/b, up $4.21/b, m-o-m, and $10.82/b, y-o-y.

November 2025 Page | 27